Ball supplies aluminum packaging for the beverage, personal care and household products industries. Co. provides aerospace and other technologies and services. Co.'s main product line is aluminum beverage containers and Co. also produces extruded aluminum aerosol containers, aluminum slugs, and aluminum cups. Co.'s segments are: beverage packaging, North and Central America; beverage packaging, Europe, Middle East and Africa, and beverage packaging, South America, all of which are engaged in manufacturing and selling aluminum beverage containers; and aerospace, which manufacture and sell aerospace and other related products.

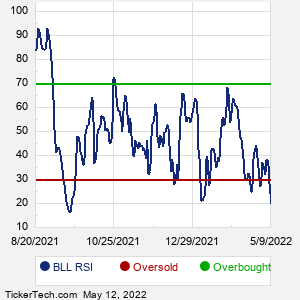

When researching a stock like Ball, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from BLL Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for BLL stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of these ways is called the Relative Strength Index, or RSI. This popular indicator, originally developed in the 1970's by J. Welles Wilder, looks at a 14-day moving average of a stock's gains on its up days, versus its losses on its down days. The resulting BLL RSI is a value that measures momentum, oscillating between "oversold" and "overbought" on a scale of zero to 100. A reading below 30 is viewed to be oversold, which a bullish investor could look to as a sign that the selling is in the process of exhausting itself, and look for entry point opportunities. A reading above 70 is viewed to be overbought, which could indicate that a rally in progress is starting to get crowded with buyers. If the rally has been a long one, that could be a sign that a pullback is overdue. |